This new investment led by Macquarie Asset Management’s specialist Green Investments team (MAM Green Investments) will support SkyNRG’s next phase of growth and help achieve its ambitious goal to become a major SAF producer through the development and operation of SAF production facilities. By 2030 SkyNRG aims to build its dedicated SAF facilities in Europe and the US, in cooperation with strategic offtake partners. To date, SkyNRG has secured partnerships with, amongst others, KLM Royal Dutch Airlines and Boeing with envisaged long term commitments of up to €4 billion in SAF purchases.

SkyNRG has been at the forefront of the development of SAF since it was founded over 14 years ago by, amongst others, Theye Veen and Maarten Van Dijk. They initially focused on creating a market for SAF and supplied the world’s first commercial flight using SAF in 2011. Since then, SkyNRG has expanded and is active in R&D, advisory services and in selling SAF. Today, the company provides SAF to airlines and corporates around the world and is still one of the leading and most active participants on the SAF market.

The SAF industry is benefitting from significant tailwinds, including voluntary corporate offtake commitments aligned to net-zero targets and growing political and regulatory support. This includes the European blending mandate (ReFuelEU) that requires the use of SAF, and the Biden Administration’s SAF Grand Challenge and the Inflation Reduction Act in the US, which is encouraging the use of SAF via strong tax incentives. By 2050, SkyNRG estimates that such incentives will create demand for up to €650 billion of investment in the sector and accelerate the aviation industry’s transition away from fossil jet fuels.

Philippe Lacamp, CEO of SkyNRG, commented: “It is critical that SAF production capacity is developed now to enable the aviation industry to meet its net-zero goals. We are very proud that Macquarie has made this strategic investment in our business and are confident that they, with the ongoing support of our existing shareholders, will provide us with the resources and expertise we need to accelerate our growth journey towards becoming a major player in the SAF industry.”

Mark Dooley, Global Head of MAM Green Investments, said: “We have a track record for backing businesses working at the forefront of the energy transition. This is an exciting milestone for us, as our first SAF investment. SkyNRG has been a pioneer in SAF, with an entrepreneurial spirit and a strong commercial focus. We look forward to collaborating with the SkyNRG team as they grow their business and advance solutions to decarbonise the aviation industry.”

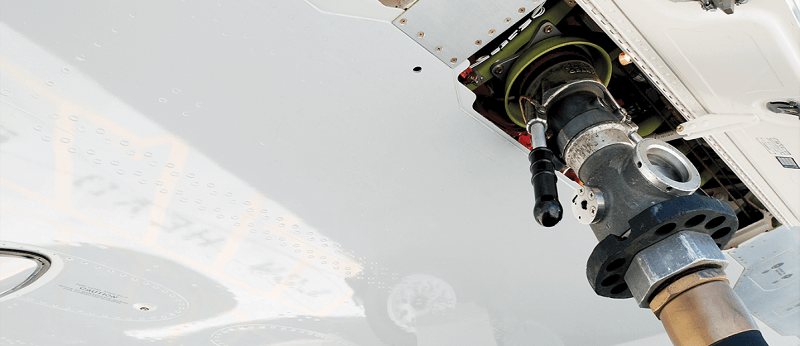

The aviation sector contributes around 2.5 per cent of global annual CO2 emissions and as the transition to net zero accelerates, SAF offers a route towards decarbonising the sector. SAF uses renewable feedstocks and can be mixed in with or replace fossil jet fuel. Based on SkyNRG’s own Life Cycle Analysis, the use of its SAF in jets can result in a minimum emissions reduction of 75 per cent compared to fossil jet fuel over its life span.

This transaction follows a series of investments by Macquarie Asset Management in emerging green technologies across Europe, including green hydrogen and biomethane producers HyCC and VORN Bioenergy.

The transaction is subject to certain closing conditions and the satisfaction of transaction terms.

SkyNRG intends to reduce the emissions of all flights taken in relation to closing this transaction using its online platform, Fly On SAF. Fly On SAF calculates the approximate emissions from a flight and allows the customer to pay for the equivalent carbon emissions reduction of their journey through purchasing SAF.

BofA Securities Europe S.A. acted as sole private placement agent to SkyNRG. Clifford Chance LLP acted as legal advisor to SkyNRG. RBC Capital Markets acted as sole financial advisor and Freshfields Bruckhaus Deringer LLP as legal counsel to Macquarie Asset Management.

-ENDS-

About Macquarie Asset Management

Macquarie Asset Management is a global asset manager that aims to deliver positive impact for everyone. Trusted by institutions, pension funds, governments, and individuals to manage approximately €543 billion in assets globally, we provide access to specialist investment expertise across a range of capabilities including infrastructure, green investments, real estate, agriculture & natural assets, asset finance, private credit, equities, fixed income and multi asset solutions.

Macquarie Asset Management is part of Macquarie Group, a diversified financial group providing clients with asset management, finance, banking, advisory and risk and capital solutions across debt, equity, and commodities. Founded in 1969, Macquarie Group employs more than 21,000 people in 34 markets and is listed on the Australian Securities Exchange.

All figures as at 30 September 2023 unless otherwise stated. For more information, please visit Macquarie.com

About SkyNRG

SkyNRG is a global leader in Sustainable Aviation Fuel (SAF). Since 2010, the company has been scaling up SAF demand and production capacity for the industry to meet its 2050 net zero commitment. SkyNRG was the first in the world to supply SAF on a commercial flight flown by co-founder and shareholder KLM in 2011. To date, SkyNRG has supplied SAF to over 40 airlines across the world and is now developing dedicated production facilities to support the shift from fossil jet fuel to sustainable aviation fuel. As a certified B Corp™ SkyNRG prioritizes producing the most responsible and sustainable SAF worldwide. Recognized as a sustainability leader, it maintains an independent Sustainability Board, which advises the company on feedstocks and provides strategic guidance on wide-ranging sustainability issues. SkyNRG’s operations are certified by RSB and CORSIA. Current shareholders of SkyNRG are Macquarie Asset Management, KLM, Spring Associates, Finestra S.A., E.M.E, and management.

Media enquiries