Final details of the UK Sustainable Aviation Fuel (SAF) mandate have been released on April 25. Read on to discover the key takeaways of the legislative initiative, summarized for you by our Policy & Sustainability team.

Short on time? Find the summary below.

Scope

The UK SAF mandate is a significant improvement compared to the initial proposal from the Department for Transport. The 2030 targets are more feasible and likely to be met due to the introduction of higher buy-out prices.

The mandate will take effect in 2025, with increasing targets up to 2040 for SAF and Power to Liquids (PtL) SAF. It applies to fuel suppliers delivering jet fuel to eligible UK airports.

Additionally, with the UK mandate coming into force, all aviation fuels will be regulated under one policy in the UK, bidding farewell to SAF eligibility under other policies.

Eligibility

Eligible SAFs under the mandate are required to reduce lifecycle greenhouse gas (GHG) emissions by 40% compared to fossil jet fuels. The threshold is much higher in the EU mandate, where a reduction of at least 65% is required.

Eligible feedstocks include:

- For SAFs, waste and residues such as used cooking oil (UCO) and forestry residues are eligible. Recycled carbon, such as waste gases from refineries or steel manufacturing are also permitted under the mandate.

- For PtL SAFs, only renewable or low-carbon electricity (e.g. nuclear) are eligible. Electricity used to produce green hydrogen or e-fuels must comply with additionality, geographical and temporal correlation criteria, similarly to the EU mandate.

SAF blending targets

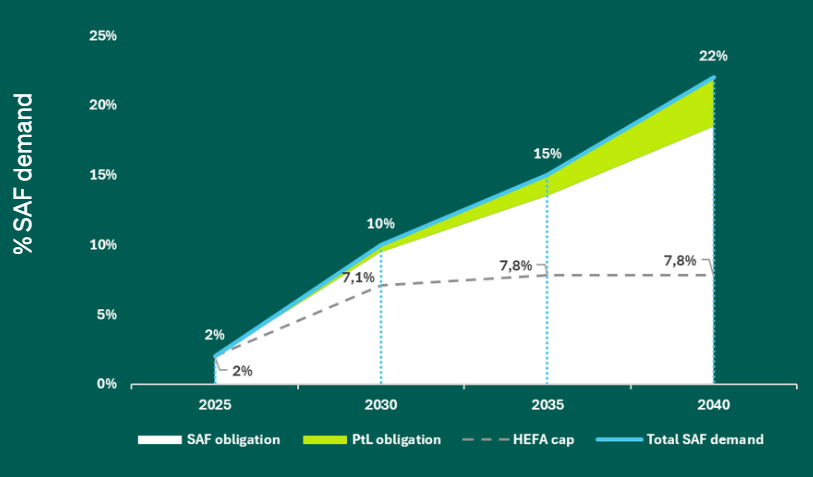

The UK SAF targets are ambitious in the short term, aiming for a 10% blend by 2030, including a 0.5% sub-mandate for PtL SAF. Overall, the mandate would require about 1.2 Mt of SAF. Compared to the EU, the level of ambition in the SAF mandate levels off post-2030, with targets only set until 2040 and defined at 22%, while the EU sits at 34%.

PtL SAF blending targets

PtL-SAF gets a sub-mandate starting in 2028, reaching 0.5% (6,000 tonnes) of SAF by 2030 and increasing to 3.5% by 2040. In contrast to the EU’s 10% target for 2040, the UK shows a more cautious approach for PtL. This suggests that the UK’s approach is focused on monitoring progress under the mandate, and potentially revising targets depending on technology progress.

HEFA Cap

The UK mandate introduces a HEFA-cap on SAF sourced from so-called ‘segregated oils’ like UCO and tallow. This is done to avoid significant diversion of feedstock from road biofuels and to encourage the production and use of advanced SAFs, e.g. made from municipal solid waste (MSW). Feedstocks that are residue derived and need extensive processing, such as tyre pyrolysis oil, remain uncapped.

While initially all SAF supply can be HEFA, it is restricted to 71% of the SAF supply by 2030. This suggests that about 0.8 Mt can be HEFA, with a market of around 0.4 Mt for advanced SAF. This provides much-needed policy certainty for SAF projects in the UK aiming to use feedstocks like agricultural and wood waste, municipal solid waste, and steel mill gas, even though the market for such fuels was larger in initial proposals of the mandate.

Buy-out price mechanism

The buy-out price is a flexibility mechanism allowing for the fuel supplier to buy out of their obligations in case SAF is extremely low in supply or prices are too high.

The buy-out mechanism will be a permanent feature of the UK SAF mandate. The prices set for SAF and PtL-SAF have been communicated to remain stable relative to the market value of the SAF and are only revised when deemed necessary for healthy market dynamics. The buy-out price for SAF is £5875 / tonne SAF, while for PtL SAF the buy-out price is fixed at £6250 / tonne SAF.

It is interesting to note that the buy-out price is not differentiated for advanced SAFs. Depending on market prices for advanced SAF in the 2030s, there may be more buy-out relative to the 2020s. Given how nascent the advanced SAF market is, the dynamics between the cost of advanced SAF and buy-out price for SAF obligations is a point of interest as it unfolds when the advanced SAF hits the market.

Ending Note

Now that the mandate is officially released, the government’s subject of interest is the Revenue certainty mechanism (RCMs).

RCMs are designed to provide comfort to investors by providing assurance on SAF market revenue while keeping market oversupply in check, with the aim of drawing private investment into UK SAF projects. This seems to be mainly targeted at nurturing a market for advanced SAF which carries larger risk today.

The UK mandate is a significant step forward in maturing markets for SAF globally, while providing more investment certainty for project developers. However, there is still room for improvement. Long-term targets are less ambitious compared to the EU, and there is a notable absence of anti-tankering measures that should improve the level playing field for aircraft operators.

Summary

Here are the main takeaways, in brief:

Targets: With a 10% mandate in 2030, the UK has set a more ambitious target compared to the EU in the near term. This equates to a mandated demand of 1.2 million tonnes of SAF. However, post-2030 the ambition decreases, with targets increasing to just 22% by 2040.

Power-to-Liquids: PtL-SAF gets a sub-mandate from 2028 on, reaching 0.5% (6,000 tonnes) of SAF by 2030 and increasing to 3.5% by 2040. Compared to the EU’s 10% target for 2040, the UK appears to consider a more cautious role for PtL-SAF.

Three policy design elements stand out from the UK mandate:

- HEFA-cap: The UK mandate includes a cap on SAF sourced from waste oils like UCO and tallow. This policy choice aims to incentivize the use of “advanced SAF”. Starting in 2027, the HEFA-cap will reach 71% of total SAF shares by 2030, representing around 0.8 Mt of HEFA-SAF, leaving about 0.4 Mt to be met by advanced SAFs.

- Buy-out prices: A buy-out price allows fuel suppliers to opt out of the supply obligation by paying a fee. Initial values proposed were too low to trigger actual SAF supply, but the UK government has reached a compromise on a buy-out price of just below $5,000/tonne for most SAFs, making buy-out less likely.

- Revenue certainty: Revenue certainty mechanisms are designed to attract investors with the assurance of reduced market risk, particularly for less mature pathways like Alcohol-to-Jet, Fischer-Tropsch. Final details on the mechanism is expected later this year after a consultation process.

This mandate represents a positive step towards providing more policy certainty for SAF developers in the UK and we expect several plants will be able to progress their projects in the UK as a result.

Want to know more?

You must be logged in to post a comment.